What is wealth? In the past, the answer might have focused on equities, property, gold, bonds and digital assets. Increasingly, though, a broader definition that embraces the natural world – forests, oceans and climate – seems more appropriate. This year’s cover and dividers visualise many of these concepts in a digital way, showing a matrix of the diverse range of materials that represent wealth today.

The year 2022 saw one of the biggest rises in interest rates in history – and a corresponding shift in investor behaviour. Asset prices fell back and overall wealth levels fell.

Last year the Ukraine crisis fuelled the European energy crunch and supercharged already surging inflation. As a result, 2022 saw one of the sharpest upward movements in global interest rates in history, leading to economic conditions which Collins English Dictionary neatly dubbed the “permacrisis”.

Liam Bailey, Knight Frank’s Global Head of Research and Editor-in-Chief of The Wealth Report

"...but now it's time to look beyond the “permacrisis” Significant risks remain for the global economy. Inflation in major economies is above target, interest rates are still rising, and consumers are facing a serious cost-of-living crisis. (...)market sentiment will shift, quickly, and investors need to be well placed to take advantage of the very real opportunities emerging across global real estate markets.

- Wealth preservation, hybrid working and early retirement themes supported resort markets, with sun (up 8.4%) and ski (8.3%) locations outperforming average prime market growth in 2022. This strength is reflected by our research into the high diversity of buyer nationalities in markets such as France, Spain and Italy.

- An ironic legacy of Covid has been a massive growth in the desire for mobility. The 13% of UHNWIs who are planning to acquire a second passport or citizenship is the tip of the iceberg. The boom in so-called digital nomads is only just starting – promising disruption to outbound countries, destination markets, tax, systems, residential rental demand and office requirements.

- Purchasers need to navigate ever more global rule changes including a Canadian ban on non-residents buying this year and next, a new mansion tax in Los Angeles, tighter lending rules in Singapore, higher fees for Australia’s non-resident buyers and a new Spanish wealth tax. With buyers confirming they are actively seeking political stability and transparency of asset ownership, though, this is looking like the new normal.

- Covid led to huge growth in mobility requirements The number of people who were suddenly able to do their existing work in a new country expanded rapidly. The “digital nomad” boom has brought many more people into the ambit of global mobility – and countries have responded by finding new ways to attract them.

- Following the global financial crisis, housing busts in markets such as Spain and Portugal spurred property-led investor visa schemes. With stronger markets, countries are changing focus towards schemes that promote job creation, innovation and entrepreneurial activity.

- Purchasers need to navigate ever more global rule changes including a Canadian ban on non-residents buying this year and next, a new mansion tax in Los Angeles, tighter lending rules in Singapore, higher fees for Australia’s non-resident buyers and a new Spanish wealth tax. With buyers confirming they are actively seeking political stability and transparency of asset ownership, though, this is looking like the new normal. Read in Reuters about the latest changes to the Golden Visa in Portugal.

- US citizens have a “good passport” with many travel privileges, but Covid threw these out the door. Suddenly, they faced challenges even to enter Europe. The result has been a huge increase in the number of Americans looking into investment migration options. If we look at demand globally, we see a shift in people’s time horizons as well, with many now looking for “medium-term” solutions, namely places where they may want to spend several months and that offer access to good healthcare as well.

- What trends are going to be seen among wealthy investors in Spain?

Investors typically make single investments of between €15 million and €25 million and target assets across Europe or further afield, sometimes for currency benefits. UHNWIs in Spain tend to prefer residential, and favour city centres. If they already own beautiful homes, then many seek to move into small build-to-rent schemes. Offices have seen some sizeable transactions from private wealth in the past year and hotels remain favourable.

- Where are the opportunities for 2023 and beyond?

There is a drive for diversification. We have one client who bought a hotel in central Madrid earning 3% and invested €65 million in a renewable energy plot with a yield of 9%. With its vast swathes of land and 350 days of sun a year, Spain will offer more opportunities in this sector.

- Spain: Billed as a temporary measure, a new “Solidarity Tax” is being levied on net assets of €3 million-plus, although Spanish resident taxpayers may apply a €700,000 reduction and an additional €300,000 is deductible for primary residences.

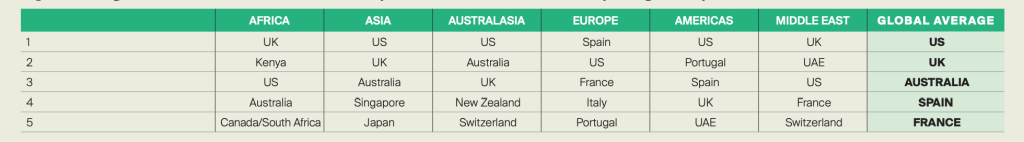

- In 2023, the top five overseas markets UHNWIs are most likely to invest in include the US, UK, Australia, Spain and France. The wealthy are targeting markets offering lifestyle benefits along with currency diversification, stable political governance and high levels of transparency.

- At a global level our data confirms France as the most international prime residential marketplace, closely followed by Spain. The table below confirms the top 10 international markets in Europe.

If purchasing a new home, where is it most likely to be located? (1 = most likely, weighted by times chosen)

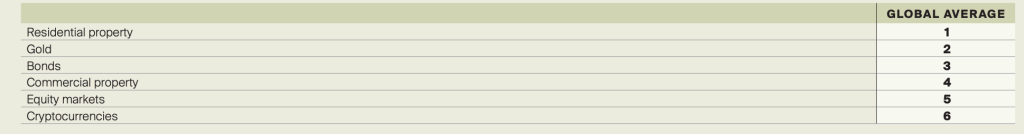

Please rank the following according to which you consider to be the safest and least volatile asset class (1 = safest)

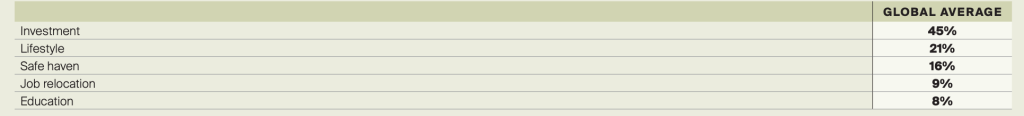

What will be the main reason behind your next residential property purchase? (% respondents)

Fortunately, 2023 has begun on a slightly more optimistic note. Inflation permitting, we could be nearing the end of the cycle of multiple interest rate hikes, with US rates rising just 0.25% in February. The reopening of the Chinese mainland has also added buoyancy to economic prospects.

But what gives me confidence is how innovative and resilient markets and investors have proven over the past five years, particularly in 2020 and 2021. The Covid-19 pandemic put more than half the global population under some form of stay-at-home orders, and many businesses were forced to move online practically overnight. Yet the global economy rebounded at almost unimaginable speed. One famous economist (the quote is attributed to both Keynes and Samuelson) said: “When the facts change, I change my mind. What do you do, sir?”

Source: Knight Frank – read the full report here.