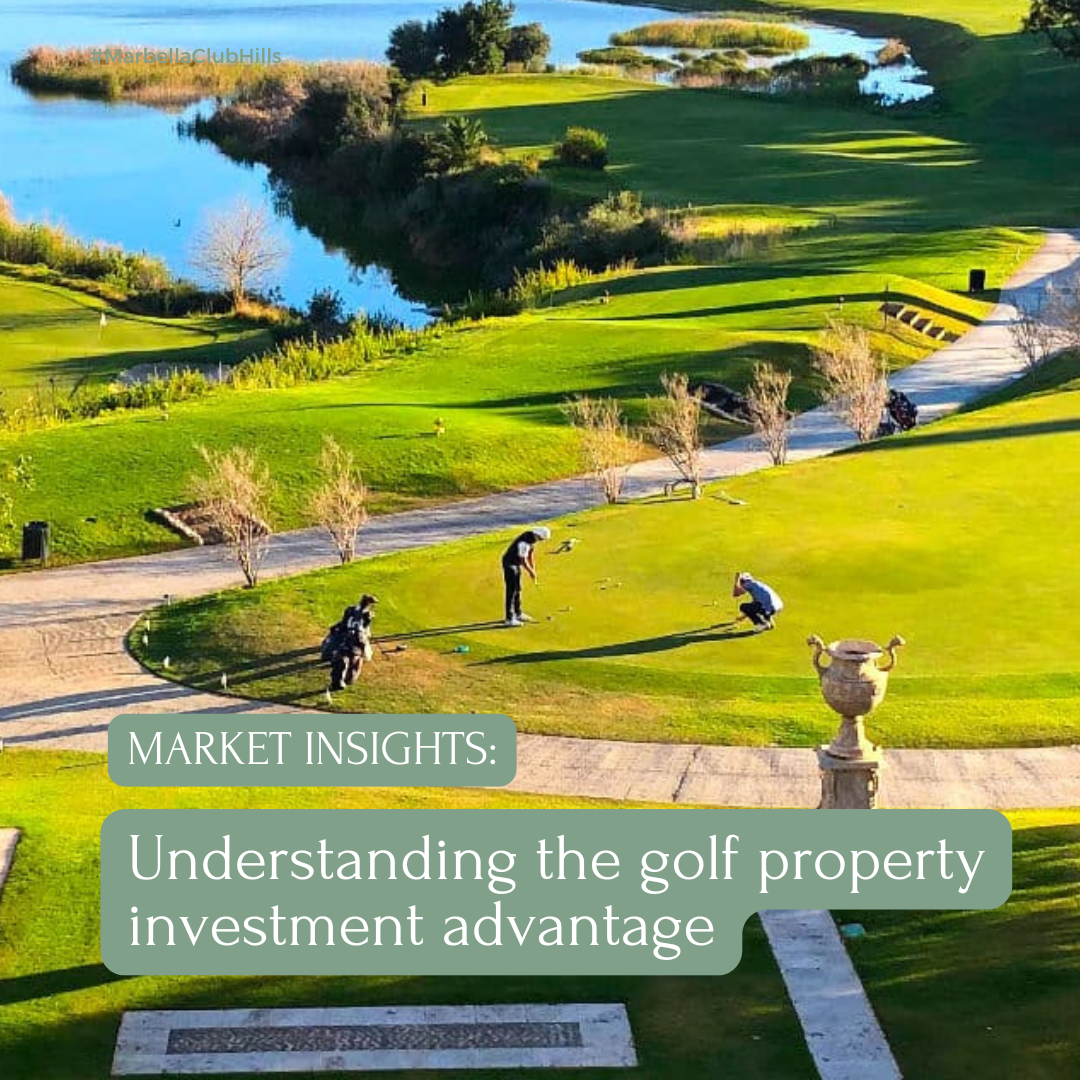

In the world of luxury real estate, location has always been paramount. But there's a particular type of location that's driving remarkable value in today's market: proximity to world-class golf courses. As the global golf tourism market surges, properties with golf course views or access are becoming increasingly coveted investments, particularly in premium destinations like the Costa del Sol.

"The global golf tourism market is expected to grow by $9.01 billion at a CAGR of 6.72% between 2023 and 2028."¹

The connection between golf courses and property values has never been more significant. Let's explore why these properties are attracting savvy investors.

The numbers behind the green

The numbers tell a compelling story. The global golf tourism market is experiencing remarkable growth, with a projected CAGR of 6.72% between 2023 and 2028.

"In Europe, the golf tourism market revenue is projected to reach approximately €6,398.5 million by 2033, expanding at a CAGR of 7.5% from 2023 to 2033."²

This growth is driven by increasing interest in outdoor activities and the rising popularity of eco-friendly golf courses. The statistics paint a compelling picture of this growing market. But what does this mean for property investors?

Why golf properties command premium prices

The allure of golf properties extends far beyond the manicured greens. These investments offer a unique combination of prestige, practicality, and potential that's increasingly attractive to savvy investors. Unlike traditional seasonal destinations, golf properties maintain their appeal year-round.

Several factors contribute to the premium valuations of golf-adjacent properties:

Year-round appeal: Unlike seasonal vacation destinations, golf properties in regions like the Costa del Sol offer year-round potential. With Spain's favourable climate, these properties maintain their rental potential across all seasons, attracting both golf enthusiasts and luxury lifestyle seekers.

"Spain is home to over 300 golf courses, with many properties near these courses commanding higher prices due to their proximity to golfing facilities."²

High- value tourism: Golf tourists consistently rank among the highest-spending visitors in the luxury travel sector. They typically:

- Stay longer than average tourists

- Spend more on accommodation and amenities

- Return to favorite destinations repeatedly

- Often transition from visitors to property owners

"The demand for such properties is fuelled by both domestic and international buyers who value the lifestyle associated with living near a golf course."²

Limited availability: Spain hosts over 300 golf courses, but properties directly adjacent to prestigious courses are inherently limited. This scarcity, combined with growing demand, creates a natural appreciation in value over time.

The Spanish advantage

Spain has emerged as a standout player in the golf property market, and it's easy to see why. With over 300 days of annual sunshine and more than 300 golf courses dotting its landscape, the country has mastered the art of blending sport with luxury living. The Costa del Sol, in particular, has become a beacon for investors, offering:

- Strategic location: Easy access from major European cities

- Climate: Over 300 days of sunshine annually

- Infrastructure: World-class courses like Valderrama

- Amenities: High-end restaurants, shopping, and cultural attractions

- Lifestyle: Blend of sport, luxury, and Mediterranean living

"Countries like Spain, Portugal, and Scotland are popular among golf tourists due to their well-established golfing infrastructure and scenic landscapes."²

"Golf tourists are high-value travellers who tend to stay longer and spend more on accommodation, transportation, and dining compared to other types of tourists."²

Future-proofing your investment

The golf property market is evolving, with several trends shaping future value:

Sustainability focus: Properties adjacent to courses that embrace environmental stewardship often command higher premiums, attracting environmentally conscious buyers and investors.

"There is a growing trend towards sustainable and eco-friendly golf tourism, which includes the development of eco-friendly golf courses that attract environmentally conscious tourists."¹

"This trend is likely to influence future real estate developments near golf courses as sustainability becomes a key consideration for buyers."¹

Technology integration: Modern golf communities are incorporating smart home technology and digital amenities, adding another layer of value to these properties.

Lifestyle enhancement: Today's golf developments aren't just about the sport – they're comprehensive lifestyle destinations offering:

- Wellness facilities

- Fine dining

- Social clubs

- Family activities

- Premium security

Investment Considerations

Success in golf property investment requires careful consideration of market dynamics. Early-phase investment opportunities often offer the best value proposition, but investors should weigh factors such as development maturity, local market conditions, broader amenity offerings, and potential for value appreciation.

For those considering golf property investment, the key factor to evaluate is the location within the golf resort.

- Direct golf course views

- Proximity to clubhouse

- Privacy and security

- Access to amenities

Our development is located within the prestigious Marbella Club Golf Resort, and it showcases the market's versatility, from elegant penthouses with sweeping course views to spacious villas designed for family living.

- Phase 1: Already completed and delivered

- Phase 2: Currently under construction:

- penthouses (3-4 bedroom),

- first-floor apartments (2-3 bedrooms), and

- duplex garden apartments (3-4 bedrooms)

- Phases 3 and 4: In the pipeline:

- 4 standalone villas (5 bedroom), and

- 6 semi-detached villas (5 bedroom).

Golf properties offer diverse income opportunities beyond traditional rental arrangements. Investors can maximise returns by capitalising on peak golf seasons, when demand surges during prestigious tournaments, while also tapping into the lucrative holiday letting market throughout the year. These multiple revenue streams, particularly during high-profile golfing events, can significantly enhance the property's overall investment potential.

Capturing the golf property premium

With the European golf tourism market showing strong growth projections and Spain's continued dominance in the sector, golf-adjacent properties represent a compelling investment opportunity. The combination of limited supply, growing demand, and the evolution of golf communities into comprehensive lifestyle destinations suggests sustained value appreciation potential.

For investors looking to enter this market, the key is to focus on properties that offer not just proximity to quality golf facilities, but also the broader lifestyle amenities that today's luxury buyers demand. As the market continues to evolve, properties that successfully blend golf access with sustainable practices and modern amenities are likely to see the strongest appreciation in value.

Ready to explore golf property investment opportunities? Contact our team to learn more about available properties and current market conditions in prime golf locations.

Note: All market projections cited are based on comprehensive research reports from Technavio:"Golf Tourism Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, Japan, UK, Canada, Australia - Size and Forecast 2024-2028"¹ and Future Market Insights:"Europe Golf Tourism Market Outlook (2023 to 2033)."²